SEA-LNG’s View from the Bridge 2023-2024 highlights the shipping industry’s progress along the LNG pathway to decarbonization in 2023 and outlines anticipated advancements in 2024.

Decarbonisation Challenge – Reality Closing In

The reality of the magnitude of the decarbonisation challenge has started to hit home for many in the maritime industry this year. From 1 Jan 2024, there remain only 312 months – 1,356 weeks or 9,497 days – until 2050, when shipping must achieve its net-zero target. Regulations such as the IMO’s CII (effective from 2023), the inclusion of shipping into EU ETS (2024) and FuelEU Maritime (2025) are putting immediate and growing pressure and added costs on ship owners and operators in relation to their GHG emissions. How to meet these goals with practical, realistic and safe solutions in 312 short months is a dilemma the industry must address in a concerted and coordinated manner.

Fuel Pathways – Highlighting Grey Areas

During 2023 SEA-LNG shone a light on some of the grey areas from alternative fuel discussions in 2023 and important considerations for 2024.

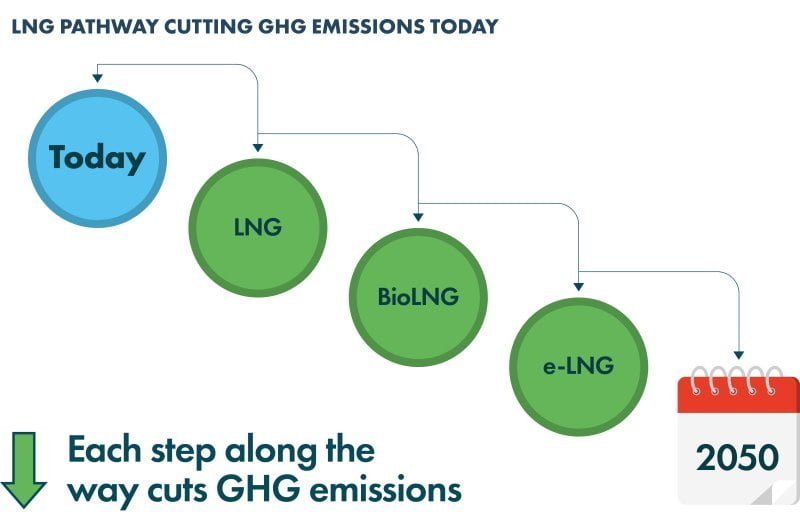

There is a growing awareness of the fact that all the alternative fuels being discussed today share the same generic pathway: from fossil to bio-derived fuels, (or blue fuels using carbon capture and storage) and eventually to electro-fuels produced from renewable electricity. There is also a recognition that currently all these fuels are fossil, or grey.

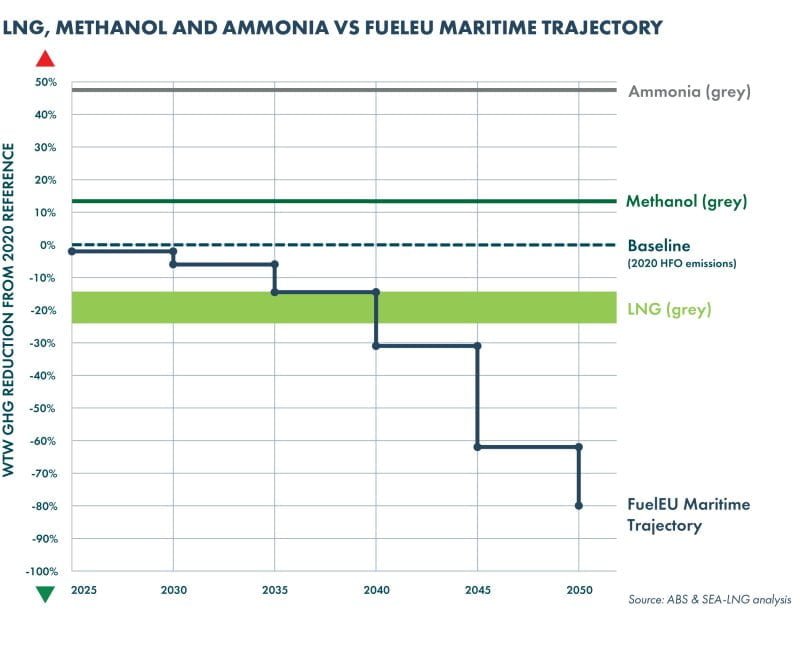

The use of grey methanol, grey ammonia and grey hydrogen as marine fuels will generate more GHG emissions than the traditional marine fuels they are looking to replace. This means they are not viable solutions for decarbonisation even in the short term. By contrast, grey LNG offers an immediate reduction in GHG emissions of up to 23%, after accounting for methane slip, for the two-stroke engines which are fitted to the vessels that move most of the world’s shipping tonnage.

Consequently, the methanol, ammonia and hydrogen used by shipping will need to be green, or at least a blend with large volumes of green fuels, simply to achieve parity with VLSFO (Very Low Sulphur Fuel Oil) and comply with regulations such as FuelEU Maritime.

With scaling green fuel supply a clear barrier to decarbonisation, we must make efficient use of scarce resources. With practicality in mind, we must also recognise that fuel availability is linked to the scale of supply infrastructure. Acknowledging these truths, it is clear the LNG pathway from LNG to bio-LNG to e-LNG clearly represents the practical and realistic pathway to net-zero shipping emissions.

“During 2023 attitudes towards decarbonisation shifted from theoretical discussions about what might work tomorrow to what works today and how much does it cost”

Peter Keller, Chairman, SEA-LNG

The maritime industry is at a critical juncture, facing the challenge of decarbonization to align with global climate goals. The International Maritime Organization (IMO) has set ambitious targets to reduce greenhouse gas (GHG) emissions from international shipping, emphasizing the urgency of transitioning to sustainable fuels. In this context, liquefied natural gas (LNG) emerges as a practical and realistic solution, providing a well-established pathway to net-zero emissions.

Meeting Regulatory Demands: The recent adoption of the revised GHG Strategy by the IMO, with targets of a 20% reduction by 2030, 70% reduction by 2040, and net-zero emissions by 2050, has spurred industry leaders into action. At COP 28, shipping CEOs called for regulatory conditions that accelerate the transition to green fuels. This resulted in the establishment of four regulatory cornerstones, all of which align with the practicality of LNG as a transition fuel.

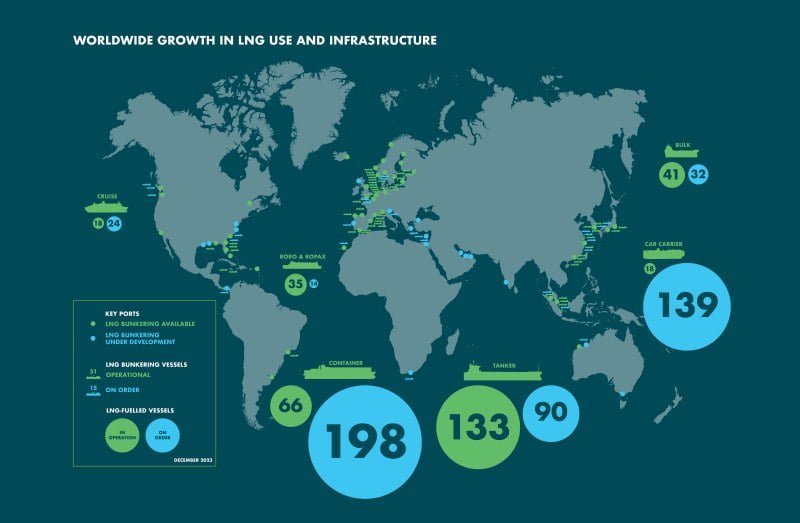

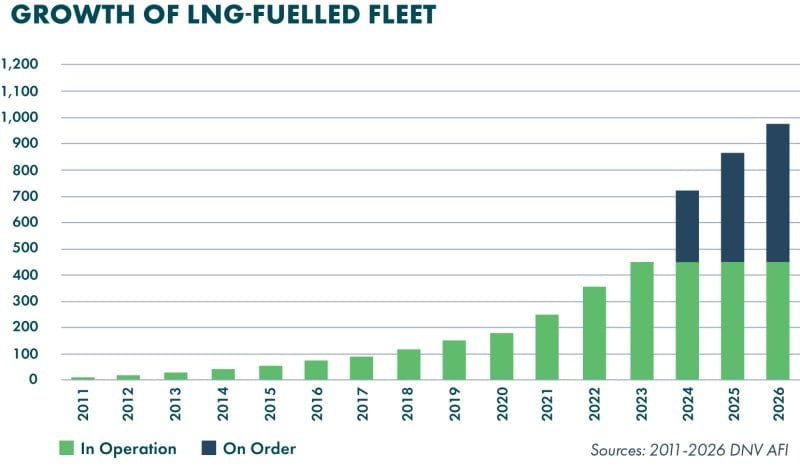

Growth of LNG-Fueled Fleet: LNG has witnessed significant growth, with 469 LNG-fueled ships in operation and 537 on order as of December 2023. This momentum is driven by its adoption across various shipping sectors, including container lines, tankers, car carriers, bulk carriers, and cruise ships. Major carriers are already embracing LNG, making it a logical focus for regulatory considerations.

LNG Bunkering Infrastructure: The global infrastructure for LNG bunkering has expanded considerably, with 188 ports offering LNG bunkering services and an additional 82 locations under active discussion. The number of LNG bunker vessels has increased from 40 in 2022 to 50, with 34 more on order or under discussion. This growth reflects the industry’s commitment to supporting LNG as a marine fuel.

Challenges in the Decarbonization Journey: As the maritime industry faces the reality of decarbonization, challenges such as meeting immediate GHG reduction targets and ensuring the availability of green fuels come to the forefront. The report highlights the urgency, with only 312 months remaining until the 2050 net-zero target. While alternative fuels like methanol, ammonia, and hydrogen are discussed, LNG stands out as a viable solution in the short and medium term.

The LNG Pathway: The LNG pathway provides that safe, realistic, and practical solution utilizing existing and proven infrastructure. There is a growing awareness of the fact that all the alternative fuels being discussed today share the same generic pathway: from fossil to bio-derived fuels and eventually to electro-fuels produced from renewable electricity.

Comparative Analysis: The report compares LNG with other alternative fuels, emphasizing the immediate GHG reduction offered by LNG, which is up to 23% on a Well-to-Wake basis. In contrast, grey methanol, grey ammonia, and grey hydrogen are projected to generate more GHG emissions than traditional marine fuels. The analysis reinforces LNG’s role as a transitional fuel that can bridge the gap towards green alternatives.

Addressing Methane Slip: Concerns about methane slip, a known issue in LNG engines, are addressed by highlighting the progress made in reducing methane slip levels. Over 50% of LNG-fueled ships on order feature engines with minimal or no methane slip. Industry initiatives like MAMII and the GREEN RAY project aim to further reduce methane slip through innovative technologies.

Bio-LNG: A Compelling Green Fuel: The report emphasizes the viability of bio-LNG as a drop-in fuel, showcasing its ability to reduce GHG emissions by up to 80% compared to marine diesel. Bio-LNG’s production, already well-established, aligns with existing infrastructure, making it a compelling choice for vessel owners and operators. The growing availability of bio-LNG globally is seen as a positive development in the transition to greener fuels.

Future Developments: e-LNG and Electro-Fuels: While acknowledging the potential of electro-fuels like e-LNG, the report highlights the challenges in scaling renewable electricity and electrolysis capacity needed for their production. Commercial quantities of electro-fuels are not expected until after 2030. In the meantime, LNG’s practicality and immediate benefits position it as a critical component of the industry’s decarbonization strategy.

The LNG pathway emerges as a beacon of hope for the maritime industry navigating the complex waters of decarbonization. With a well-established infrastructure, proven operational history, and immediate GHG reduction benefits, LNG provides a realistic and practical solution to meet regulatory demands. As the industry charts its course toward a net-zero emissions future, LNG stands out as a cornerstone in the journey towards a sustainable maritime sector.

Source: SEA-LNG – Read the Full Report CLICK HERE