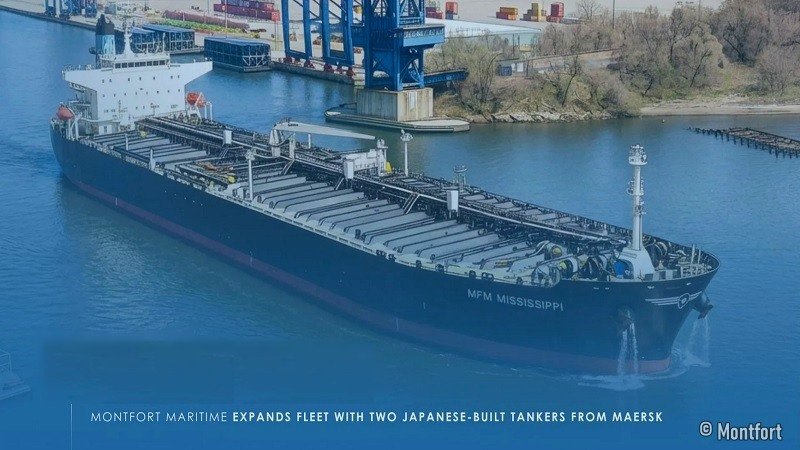

Geneva, Switzerland | November 28, 2025 – Montfort Maritime, the rapidly expanding shipping arm of the global commodity trader Montfort, has further solidified its presence in the product tanker market with the acquisition of two high-specification, Japanese-built vessels from Maersk Tankers.

The deal, confirmed on November 28, 2025, sees the 48,020-dwt Maersk Maru (2011-built) and the 47,990-dwt Maersk Mississippi (2010-built) join Montfort’s growing fleet. The move signals a clear intent by the Geneva-headquartered firm to enhance its freight capabilities and support its integrated energy trading model.

Table of Contents

Strategic Asset Selection

Montfort has characterized the acquisition as a “disciplined, cycle-aware” investment. The decision to target Japanese-built Medium Range (MR) product tankers aligns with the company’s strategy of securing high-quality tonnage that offers a balance of immediate earnings potential and resilient long-term asset value.

Key highlights of the acquired vessels include:

- Recent Maintenance: Both tankers have recently completed extensive drydocking and special survey work, ensuring they are “ready to trade” without immediate technical capital expenditure.

- Optimal Age Segment: Positioned in a commercially attractive age bracket, these vessels are ideal for the current global product trade, which has seen increased demand for modern, reliable MR units.

- Operational History: Formerly part of the Maersk Tankers Singapore fleet, the vessels carry a pedigree of high-standard maintenance and operational excellence.

A Year of Rapid Fleet Expansion

This latest transaction follows a highly active year for Montfort Maritime. Earlier in 2025, the company structured a significant deal with Union Maritime for two modern HMD-built MRs, the Tweed (2019) and the Witham (2020).

By integrating these four vessels into its portfolio within a single calendar year, Montfort is transitioning from a charter-heavy model to a sophisticated owner-operator. This shift provides the group with greater control over its supply chain, particularly in its core markets across Europe, Africa, and Asia.

“Our shipping and trading activities continue to grow in scale and geographic reach. Securing high-quality assets from selective sellers like Maersk reflects our commitment to building a resilient, modern shipping line.” Montfort Maritime Said

Strengthening the Integrated Trade Flow

For a company like Montfort, which already holds a dominant position in the Fujairah bunkering hub through its Fort Energy refinery, owning its freight capacity is a natural evolution. The addition of these MR tankers allows for:

- Direct Feedstock Control: Supporting the movement of products to and from their strategic storage and refining assets.

- Market Arbitrage: Utilizing owned tonnage to capitalize on shifting global product spreads.

- Sustainability Integration: Aligning with the group’s broader ESG goals by operating well-maintained, efficient Japanese-built tonnage.

As of late 2025, Montfort Maritime operates out of key global hubs in Geneva, Dubai, and Singapore, further cementing its role as a key player in the intersection of commodity trading and international shipping.

About Montfort: A Global Leader in Commodity Trading and Asset Investment

Montfort is a global leader in commodity trading and asset investment. Managed by a diverse team of highly skilled professionals with decades of experience, Montfort engages in the trading, storing, and transportation of energy and commodities. The company is committed to delivering innovative services with integrity and efficiency, creating long-term value for its clients. By understanding client needs and becoming long-term partners, Montfort Maritime is positioned to continue leading in the sectors it serves, driving positive change and delivering sustainable results.

Source: Montfort