Shell Eastern Trading Pte. Ltd., a subsidiary of Shell plc, has announced a definitive agreement to acquire 100% of Pavilion Energy Pte. Ltd. from Carne Investments Pte. Ltd., an indirect wholly owned subsidiary of Temasek. This strategic acquisition includes Pavilion Energy’s global liquefied natural gas (LNG) trading business, which has a contracted supply volume of approximately 6.5 million tonnes per annum (mtpa).

Pavilion Energy, headquartered in Singapore, is a significant player in the energy sector, with operations encompassing LNG trading, shipping, and natural gas supply and marketing across Asia and Europe. The acquisition is poised to significantly bolster Shell’s leadership in the global LNG market.

Table of Contents

Strengthening Shell’s LNG Leadership

“The acquisition of Pavilion Energy will strengthen Shell’s leadership position in LNG, bringing material volumes and additional flexibility into our global portfolio,” said Zoë Yujnovich, Shell’s Integrated Gas and Upstream Director. “We will acquire Pavilion’s portfolio of LNG offtake and supply contracts, which includes additional access to strategic gas markets in Asia and Europe. By integrating these into Shell’s global LNG portfolio, Shell is strongly positioned to deliver value from this transaction while helping to meet the energy security needs of our customers.”

This transaction aligns with Shell’s strategic growth ambitions, aiming for a 15-25% increase in purchased LNG volumes by 2025 compared to 2022, as outlined during Shell’s 2023 Capital Markets Day.

Integration and Future Plans

The integration of Pavilion Energy’s portfolio, which includes about 6.5 mtpa of long-term sale and supply LNG contracts, is expected to commence after the deal’s completion in Q1 2025, pending regulatory approvals and fulfillment of other conditions precedent. The portfolio also includes long-term regasification capacity of approximately 2 mtpa at the Isle of Grain LNG terminal in the United Kingdom, as well as regasification access in Singapore and Spain. Additionally, Pavilion Energy has time-chartered three M-type, Electronically Controlled Gas Injection (MEGI) LNG vessels and two Tri-Fuel Diesel Electric (TFDE) vessels, along with an LNG bunkering business that deployed its first vessel in early 2024.

Pavilion Energy’s pipeline gas business is excluded from the transaction and will be transferred to Gas Supply Pte Ltd (GSPL), a wholly-owned subsidiary of Temasek, prior to the deal’s completion. Furthermore, Pavilion Energy’s 20% shareholding in blocks 1 and 4 in Tanzania will not be part of the transaction.

Global LNG Demand and Shell’s Role

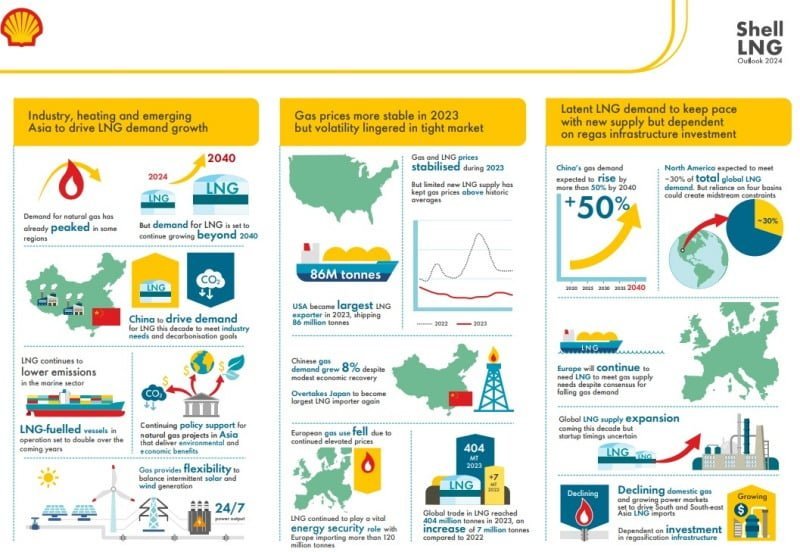

Global demand for LNG is projected to rise by more than 50% by 2040, driven by industrial coal-to-gas switching in China and other South and Southeast Asian countries, according to Shell’s LNG Outlook 2024. LNG is seen as a crucial element in the energy transition, replacing coal in heavy industry and power generation, thereby reducing local air pollution and carbon emissions.

Shell plans to expand its LNG business by 20-30% by 2030, relative to 2022, and this acquisition is a strategic step toward achieving that goal. The company’s longstanding presence in Singapore includes being the holder of the first LNG importing license and supplying nearly a quarter of the country’s natural gas needs for over a decade.

About Shell

Shell has been a pioneer in developing LNG as a marine fuel for bunkering in Singapore, actively contributing to the region’s energy supply security. The company trades in LNG, crude, oil products, and other energy commodities, serving customers across Asia reliably and competitively. For more information about Shell’s Energy Transition Strategy 2024 and the role of LNG in the energy transition, please visit Shell’s official website.

About Pavilion Energy

Pavilion Energy is a wholly owned subsidiary of Temasek. Headquartered in Singapore, its global energy business encompasses natural gas supply and marketing activities in South-East Asia and Europe; and global LNG trading, shipping and optimization; as well as energy hedging and financial solutions. Pavilion Energy has also been a pioneer by developing LNG bunkering for the maritime industry and by promoting greenhouse gas emissions reduction and carbon offsets in the LNG value chain. As an advocate for LNG and natural gas as fuels of choice, we are driving energy transition efforts towards a more sustainable future for generations to come.

Source Shell