Standard Club – As one of the world’s leading P&I insurers, we are committed to helping our members and shipowners across the globe make a safe, sustainable and successful transition to greener energy solutions.

The maritime industry is embarking on a major transition from conventional to zero or carbon neutral fuels driven by the pressure to decarbonise. The transition will not take place over night and will have a significant impact on costs, asset values, and earning capacity. The industry participants will need to understand the drivers and implications now to be able to plan accordingly and assess the associated risks.

Whilst regulations will set direct requirements that shipowners must comply with, the public as well as third-party stakeholders (including governments, classifications societies, ports, shipyards, banks and cargo owners) will increasingly have high expectations that will require transparency and promote decarbonisation. Access to finance for newbuilds will also be dependent on shipowners being able to demonstrate that they can meet decarbonisation targets.

Table of Contents

Why are alternative fuels being considered by the industry?

The International Maritime Organization (IMO) reports that maritime transport is responsible for about 3% of global greenhouse gas (GHG) emissions (IMO Fourth GHG study). To reduce emissions and align international shipping with the temperature goals under the 2015 Paris Agreement,[1] the IMO adopted an Initial Strategy in 2018 on the reduction of GHG emissions from shipping (i.e. emissions including carbon dioxide (CO2), methane (CH4) and nitrous oxide (N2O), expressed in CO2e (carbon dioxide equivalent)). The Initial Strategy is a policy framework which sets key objectives to:

- reduce average carbon intensity (carbon dioxide (CO2) emissions per transport work) of international shipping by at least 40% by 2030, while pursuing efforts towards 70% by 2050, as compared to 2008 levels; and

- reduce total annual GHG emissions from shipping by at least 50% by 2050 compared to 2008, while pursuing efforts towards phasing them out entirely within this century.

The short, mid, and long-term measures to achieve these objectives remain a topic under intense discussion. The Initial Strategy is expected to be revised in 2023.

The use of alternative fuels is considered key to achieving the Initial Strategy goals because, whilst other energy efficient measures might achieve some reduction in GHG emissions, alternative fuels will be transformative and ultimately are capable of significantly reducing, if not eliminating, such emissions.

[1] The Paris Agreement excluded shipping due to its international scope. Climate-related shipping regulation was delegated to the IMO.

What are GHGs?

GHGs trap heat in the earth’s atmosphere. Whilst carbon dioxide is the dominant GHG for shipping, GHGs include a basket of six harmful gases:

- Carbon dioxide (CO2)

- Methane (CH4)

- Nitrous oxide (N2O)

- Hydrofluorocarbons (HFCs)

- Perfluorocarbons (PFCs)

- Sulphur hexafluoride (SF6)

- Nitrogen trifluoride (NF3)

Is the IMO Initial Strategy regime mandatory? If so, how will it be enforced?

The Initial Strategy itself is not mandatory. However, the IMO can adopt measures to implement the Initial Strategy by amending existing conventions which are mandatory in many jurisdictions (such as the International Convention for the Prevention of Pollution from Ships (MARPOL).

The requirements imposed by the revisions to MARPOL (see para 5 below) are mandatory for all cargo and cruise vessels trading internationally and which are above the gross tonnage specified in the amendments and registered in a MARPOL-signatory country. Enforcement of such amendments will be through flag states which are parties to MARPOL.

Has the IMO adopted measures in furtherance of the Initial Strategy objectives?

Yes. In June 2021, the IMO’s Marine Environment Protection Committee (MEPC) held its 76th session (referred to as ‘MEPC 76’) and adopted measures aimed at the Initial Strategy objectives. These measures include amendments to Annex VI of MARPOL.

The revised Annex VI requires ships over 400 GT and operating internationally to calculate their Energy Efficiency Existing Ship Index (EEXI). The EEXI is a design rating which will reflect the ship’s energy efficiency as compared to a baseline target for ships of that type and size. The EEXI requirements are in addition to the existing Energy Efficiency Design Index (EEDI) requirements which are applicable to the design and construction of new ships (see no. 7 below). The EEXI baseline target for a vessel will be based on a reduction factor expressed as a percentage relative to the EEDI baseline set for new ships of the same type and size. Existing vessels will be required, among other things, to have an actual calculated EEXI (‘attained EEXI’) below the targeted EEXI (‘required EEXI’) for the vessel. The EEXI requirements do not mandate modifications to existing ships, but realistically, modifications may be necessary to achieve the required EEXI for a particular ship.

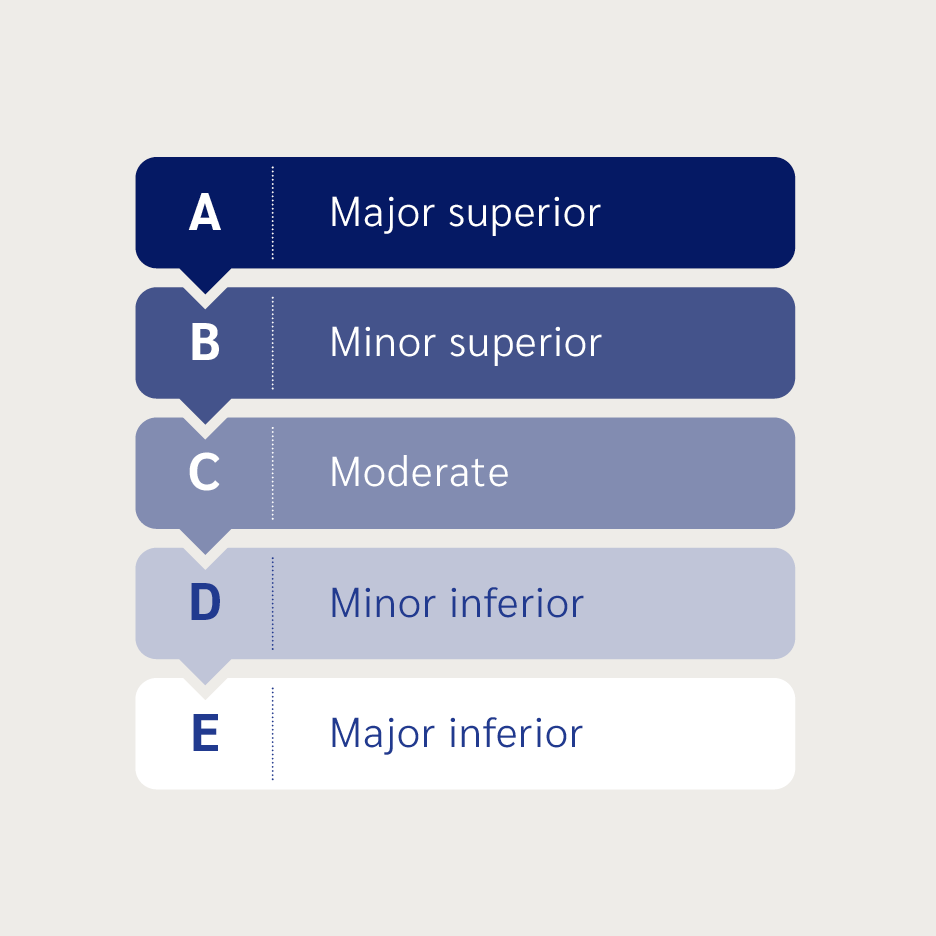

MARPOL Annex VI also requires ships over 5,000 GT to establish an annual operational carbon intensity indicator (CII) and rating. Shipowners must calculate annually a CII for each ship accounting for cargo carried. The CII rating scale will be A, B, C, D, or E (with A being the best). The CII scale will require progressively higher efficiency standards each year, through 2030. Shipowners therefore should also develop plans to cut the CII to reach the progressive ship-specific targets whereby the CII of a ship is reduced annually. The flag state will compare a ship’s reported CII to its target and produce the CII rating. A ship rated D for three consecutive years or E (on one occasion) will be required to submit a corrective action plan to show how a rating of C or above will be achieved.

What is the timeline for implementation of the EEXI and CII measures adopted by the IMO?

As explained in para 5, the EEXI and CII regulations were adopted in 2021 through revisions to MARPOL Annex VI. The amendments are expected to enter into force on 1 November 2022, with the EEXI survey requirements taking effect in November 2022 and the EEXI and CII certification requirements coming into effect from 1 January 2023. The first annual EEXI and CII reports will accordingly be due in 2023. The EEXI and CII measures will then be reviewed by the IMO for effectiveness in 2026.

What is the EEDI?

The Energy Efficiency Design Index (EEDI) reflects the theoretical design efficiency of a new build ship.[1] EEDI was made mandatory with the adoption in July 2011 of amendments to MARPOL Annex VI. The EEDI regulations mandate a minimum required energy efficiency level per capacity mile (e.g., tonne mile) for different ship types and sizes. The EEDI requirements are to be implemented in phases. New container ships, general cargo ships, LNG carriers, large gas carriers (>15,000 DWT), and cruise ships (having non-conventional propulsion, are all subject to the Phase 3 EEDI requirements from 1 April 2022. For most other ships, Phase 3 comes into force in 1 January 2025.

[1] As per IMO Resolution MEPC.203(62), ‘new ship’ means a ship:

- for which the building contract is placed on or after 1 January 2013; or

- in the absence of a building contract, the keel of which is laid or which is at a similar stage of construction on or after 1 July 2013; or

- the delivery of which is on or after 1 July 2015.

Are the EEXI, EEDI, and CII measures enough to hit the lower emission targets in the IMO’s Initial Strategy?

Some experts believe the 2030 target can be achieved through the EEXI, EEDI, and CII measures. However, it is widely accepted that much more will need to be done to meet the 2050 targets. In particular, the adoption of alternative fuel technologies is required.

Is there a possibility that the IMO’s GHG strategy will be revised?

Yes. Delegates at the 2021 United Nations Climate Change Conference (COP26) called for the shipping community to go further than the Initial Strategy and to aim for net zero by 2050. This was re-iterated at the seventy-seventh session of the Marine Environment Protection Committee (MEPC-77) held from 22 to 26 November 2021.. Some member states expressed the view that the short-term measures adopted by MEPC-76 in June 2021 are inadequate to address the Paris Agreement temperature goals and that more efforts are needed. Consequently, MEPC-77 agreed to continue the discussions on mid and long-term measures and to initiate a revision of the Initial Strategy. The final draft of the Revised Strategy is expected to be considered for adoption by MEPC-80 (scheduled for spring 2023).

Are there regional or national efforts to address GHG emissions and the use of alternative fuels?

Yes, in some regions (i.e., EU) and it is likely more will follow.

The European Union

The EU is moving ahead with its own plan to reduce GHG emissions from the shipping sector. For example, since 2018, large ships over 5,000 GT loading or unloading cargo or passengers at ports in the European Economic Area have had to monitor, report, and verify CO2 emissions (EU-MRV). Further, in July 2021, the European Commission announced its ‘Fit for 55’ package of proposals. The proposals are intended to reduce the EU’s total GHG emissions by 55% by 2030 with the goal of complete decarbonisation by 2050.. The proposals are subject to further discussion and negotiation with the European Council and European Parliament and are thus not yet finalised.

In their present form, four of the ‘Fit for 55’ proposals are relevant to shipping:

- Emissions Trading System (ETS): The package proposes incorporating shipping in the EU’s ETS from 2023. The proposal would mandate those ships that operate within EU waters to pay for their carbon emissions with the proceeds going toward development of infrastructure for cleaner alternative fuels. The extension would apply to emissions from intra-EU voyages, to 50% of the emissions from extra-EU voyages, and to emissions from ships while at berth in EU ports. Non-compliance will result in fiscal penalties being applied and may eventually lead to the ship being banned from EU waters.

- Alternative Fuels Infrastructure Regulation: This proposed regulation will require EU member states to provide adequate recharging and refuelling infrastructure which will effectively involve ramping up the availability of LNG by 2025 and onshore electrical power by 2030 in core EU ports. The introduction of this regulation will involve repealing Directive 2014/94/EU on the deployment of alternative fuels infrastructure.

- Energy Taxation Directive: This proposal would remove the tax exemption for conventional fuels used at and between EU ports as of 1 January 2023. The tax exemption presently in place for international bunkering for extra-EU voyages will remain. The tax rate for heavy fuel oil will be approximately €37 per tonne whereas the tax rate for LNG will initially be €0.6 per gigajoule. Alternative fuels will be tax exempt for a 10-year period.

- FuelEU Maritime Regulation: The proposed regulation would impose limits on GHG emissions (including CO2, methane, and nitrous oxide) of ships of 5,000 GT and above, regardless of their flag, arriving or departing EU ports and an obligation on EU ports to become carbon neutral. If adopted, the regulation will require ships to reduce their annual GHG intensity by 2% in 2025 as compared to 2020 levels with incremental increases over the years to achieve a 75% reduction by January 2050.

The United States

President Biden announced in April 2021 that the United States (US) will join the IMO effort to reduce GHG emissions in international shipping. He suggested that the US will aim to achieve net zero GHG emissions by 2050, with an interim goal to cut GHG emissions by 50% by 2030 (compared to 2005 emission levels – which was a peak year for emissions in the US). The US has not, to date, enacted its own specific measures for achieving such GHG emission reduction targets.

However, individual states may pursue their own measures. For instance, California modified a regulation in 2020 which will require every vessel calling at a regulated Californian port either to use shore power or a technology approved by the California Air Resources Board to reduce specified emissions. The regulation (known as the ‘At Berth’ regulation) currently applies to container ships, reefers, and cruise ships. The updated regulation applies as of 2023 when container ships, reefers, and cruise ships will transition to the new regulation. Car carriers will need to comply starting in 2025. Tankers calling at the Ports of Los Angeles and Long Beach must comply as of 2025, and tankers calling in Northern California will have to comply as of 2027.

For information on decarbonisation efforts in the US inland waterway sector, please see the American Bureau of Shipping publication available on its website by clicking here.

Which alternative fuels are being considered for international shipping?

As matters stand, the main alternative fuels being considered include liquefied natural gas (LNG), liquefied petroleum gas (LPG), hydrogen (H2), ammonia (NH3), methanol (CH3OH), and biofuels.

What are the advantages & disadvantages of each type of alternative fuel?

The table below provides an overview of advantages and disadvantages of the main alternative fuels being considered for the shipping sector:

| Alternative Fuels | Advantages | Disadvantages |

| Liquified Natural Gas (LNG) | Already in practical use, Infrastructure being developed, Lower in cost as compared to traditional marine fuels, High energy density, Specific regulations for LNG in IMO’s International Code of Safety for Ships using Gases or other Low-flashpoint Fuels (IGF Code) | Commonly known as a ‘transition fuel’ as reduction of CO2 emissions is limited, Requires a temperature of -162C to stay in liquid state, Low volumetric density (storage takes nearly twice the space of traditional marine fuels) Bunkering, storage and handling requires much more care than traditional marine fuels, Methane slip (GHG impact 25 times greater than CO2 emissions) Possible criticism for the use of fossil fuel |

| Liquified Petroleum Gas (LPG) | Lower in cost as compared to traditional marine fuels | Similar to LNG, reduction of CO2 emissions is limited, As with LNG, LPG storage requires larger tanks, Limited operational experience, Lack of bunkering infrastructure, Slippage factor (GHG impact 3-4 times higher than CO2 emissions) Possible criticism for the use of fossil fuels |

| Biofuels | Commonly used biofuels are hydrotreated vegetable oil (HVO) and biodiesel (FAME, fatty acid methyl ester) Carbon neutral – derived from biologically renewable resources such as plant-based sugars, etc. Usually blended with traditional marine fuels or used as a ‘drop-in’ fuel, compatible with current conventional marine engines. | Higher in cost as compared to many fossil fuels, Technical issues that could lead to machinery breakdown if not managed properly – storage stability, biological growth (biofouling), acidity, plugging of filters, and increased engine deposits, Limited production capacity and availability |

| Hydrogen (H2) | No CO2 emissions, Suitable for use in fuel cells for small vessels, ‘Green’ production by way of electrolysis powered by renewable energy is possible, Falling cost of renewable energy may lower green production costs. | Does not exist naturally – produced mostly from fossil fuel sources (energy-intensive process). ‘Green’ production currently expensive, Low energy density, Large fuel volume (require 8 times more volume than fuel oils for equal power output) – consequent storage capacity issues, Fuel cells not currently capable of powering large vessels, Requires a temperature of -253C to stay in liquid state, Immaturity of bunkering technologies, Lack of bunkering infrastructure, Highly combustible and explosive, giving rise to safety issues, Combustion produces nitrous oxides (NOx emissions)Large capital investment needed for storage and refuelling infrastructure for shipping |

| Ammonia (NH3) | No CO2 emissions Conversion process relatively cheap and uncomplicated ‘Green’ production, using green hydrogen and renewable power for the conversion process, is possible, Higher energy density than hydrogen; storage requires refrigeration only, Already produced in substantial volumes for the chemical industry Handling issues in relation to marine transportation are already well understood, Used for combustion in gas turbines | Currently made using natural gas. The conversion process requires an additional input of energy compared to green hydrogen, Requires energy input for refrigeration, Less energy dense than fuel oils, Large fuel volume (approx. 2.7 times that of HFO) N2O emissions (GHG impact is 300 times greater than that of CO2 emissions) Highly toxic – requires careful handling, Technical challenges in combustion, such as low flammability (without pilot fuels) and difficulties in increasing engine output, Requiring larger storage capacity and/or more frequent refuelling, Large capital investment needed for storage and refuelling infrastructure for shipping |

| Methanol (CH3OH) | Liquid at ambient temperatures, no need to heat or cool, Easy to store and handle, Low cost for conversion of existing engines, Minor modifications to existing storage and bunkering facilities, Widely traded, well understood and already available in some ports for bunkering, Biodegradable, with a lower impact on the environment in the event of spillage, More energy dense than hydrogen and ammonia, Clean burning fuel with low levels of SOx, NOx and particulate matter. | Production mainly from natural gas or coal, as such reduction of CO2 emissions is limited, Lower energy density than fuel oil, Large fuel volume approx. 2.4 times that of fuel oil – requiring larger storage tanks and/or more frequent bunkering, Low flash point represents a fire risk, Toxic when inhaled, ingested or handled, Increased corrosion risks, Large capital investment needed for more widespread storage and refuelling infrastructure for shipping |

What about electricity, wind, or solar power as alternative energy sources?

In recent years, pure battery-electric propulsion, using lithium ion (Li-ion) batteries, has been successfully applied on small, short-sea vessels. Presently, range limitations on the use of electricity make it unsuitable for most ocean-going applications. The potential for batteries in combination with a two-stroke main engine in a hybrid system is being evaluated for larger ocean-going vessels.

Wind and solar technologies are also being considered in conjunction with the use of other technologies.

Which fuel(s) is/are likely to become the main alternative fuel?

There is no one-size-fits-all solution. Various factors will have to be considered in selecting an appropriate fuel type based on vessel type, age of the ship, trading area, retrofitting costs, operating budget, fuel price/availability, infrastructure development, etc.

Choosing the right fuel strategy is one of the most important decisions an owner will have to take for a current new build. The key will be to optimise the fuel storage and propulsion system of the ship to accommodate current and future fuel requirements. A vessel built now faces a significant risk that the most competitive fuel in the ship’s early life will not be the same subsequently.

What are owners doing in terms of new buildings and what is the outlook?

The industry reports there is an increase in newbuilds on order that have alternative fuel systems or dual-fuel capabilities. Except for electrification in the ferry segment, the alternative fuels being used are still mainly fossil based and are dominated by LNG.

There will be demonstration projects for onboard use of hydrogen and ammonia by 2025 paving the way for zero-carbon ships, and these technologies may be ready for commercial use in four to eight years. Methanol technology is more mature and has already seen first commercial use.

A range of new technologies are emerging including fuel cells, carbon capture, and storage (CCS), as well as wind power.

As owners consider these and other technologies for their newbuilds, they will be evaluating the economic potential of fuel and energy-efficiency strategies over the lifetime of a ship. This will entail a review of the impact of the chosen fuel strategy on ship design. Considering the significant uncertainties involved over the lifetime of a ship, they will need to focus on fuel flexibility and fuel ready solutions to ease the transition and minimise the risk of investing in stranded assets.

What about safety?

Ensuring safety is of paramount importance in achieving the successful and timely roll out of new fuels such as hydrogen and ammonia. The development of safety regulations and guidelines will be necessary to evolve from large scale demonstration models to commercial use.

IMO’s International Code of Safety for Ships using Gases or other Low-flashpoint Fuels (IGF Code) addresses standards for ships using low-flashpoint fuel in general, but the current version focuses on regulations to meet the functional requirements for gas fuel (LNG). During the 7th session of the IMO Sub-Committee on Carriage of Cargoes and Containers (CCC-7), which was held from 6 to 11 September 2021, a work plan was agreed for the development of provisions for new low-flashpoint fuels under the IGF Code, including hydrogen, ammonia, LPG and methyl/ethyl alcohols.

Are some alternative fuels better suited for certain ship types or trades?

For a fuel to become widely used, it must have adequate scalability, i.e., both the infrastructure and the demand must be there, and it must be generally price competitive for take up. This may be easier to achieve for ships on regular liner routes. Those travelling between ports (i.e., bulk vessels on tramp trades) will have a difficult time sourcing the scarcer options.

Are alternative fuels presently available in key world ports? It not, when will they be?

LNG is presently the most readily accessible alternative fuel but is still not easy to source and certainly not carbon free. LNG (Bio-LNG and E-LNG) and Biofuels are good options for transitional fuels.

Methanol is only available in limited areas and is not yet in sufficient quantities to satisfy the requirements of the industry.

For the other alternative fuels under consideration, testing, development and creation of associated infrastructure is still on-going and they are not yet readily available.

What are the overall risks and impact to vessel operations associated with the use of alternative fuels?

A myriad of risks and costs considerations arise when selecting and using an alternative fuel. Some of these are identified in the table above. The principal risks and challenges concern crew safety, energy output compared to storage requirements onboard, and the availability of bunkering facilities.

Biofuels bring technical challenges concerning oxidation stability, cold flow properties, risk of microbial growth, clogging of filters, and increased engine deposits. They thus require careful handling.

During the 9th session of the IMO’s Sub-Committee on Pollution Prevention and Response (PPR-9), held on April 2022, it was agreed clarity on the use of biofuels on board ships is required. The Unified Interpretation provides a definition for the term “biofuel” and indicates that a fuel oil which is a blend of not more than 30% by volume of biofuel should meet the requirements of regulation 18.3.1 of MARPOL Annex VI, while a fuel oil which is a blend of more than 30% by volume of biofuel should meet the requirements of regulation 18.3.2 of MARPOL Annex VI. This will be presented for approval by MEPC-78 (scheduled to be held in Jun-2022).

Gases in liquid form typically require storage at cryogenic temperature and specific safety standards will need to be satisfied. Hydrogen, for example, has a wide flammability range, while ammonia is highly toxic. Stringent measures will be required to protect crew from harmful exposure, and training will be required.

Hydrogen is a clean fuel, however, manufacturing it is energy-intensive and may have carbon by-products. What is now called brown hydrogen is created through coal gasification. The process for producing grey hydrogen from natural gas releases carbon waste in the atmosphere. Blue hydrogen utilises the same process that is used to produce grey hydrogen but with carbon capture and storage, and hence it has a lower environmental impact as compared to grey hydrogen. Green hydrogen production, although currently expensive, is seen by many as the ultimate solution and uses renewable energy to create hydrogen fuel.

Green ammonia will cost two to four times as much to make as conventional ammonia. The green and blue ammonia value chains differ in the hydrogen production method used. Green ammonia is generated from water electrolysis while blue ammonia is generated using natural gas, with the addition of carbon capture.

In terms of storage capacity, energy density/calorific value of the fuel is critical. More storage space on the ship will be required if a fuel does not have an energy density that is at least comparable to that of traditional fuel. Hydrogen, ammonia, and methanol, for example, all have a lower density, requiring larger storage tanks onboard ships.

Considering the current lack of alternative fuel infrastructure, and the absence of a present clear ‘winner’ amongst the alternative fuel options, is there another fuel option to consider in the interim?

Possibly. A transitional fuel created by using additives or blending other products with traditional fuel or LNG (which is more readily available now than other alternative fuels) might be an option for reducing vessel GHG emissions while more permanent solutions are considered. An example is LNG with 20% hydrogen. Different transitional fuel choices are likely to be available depending on the vessel and trade. Such transitional fuels may require modifications to the vessel and carry their own risks.

What are some of the technologies or vessel modifications that shipowners can consider in addition to or apart from the use of alternative or transitional fuels?

Many emerging technologies and potential vessel modifications are being considered including the following:

| Energy efficiency technologies (EETs) | |

| Hull form optimisation | Hull optimisation focuses on minimising the wave resistance and friction between water and hull. The reduced frictional resistance increases energy efficiency of the ship, particularly at reduced speeds. Below are ways in which hull hydrodynamic performance may be improved:Fore body (bow) optimisationAft body optimisationAppendage ResistanceOptimisation measures are generally applied on new-built ships but also in the retrofitting of existing ships. However, it is important to understand in detail the ship’s performance and its operating profile before considering any design modification. Usually, a comprehensive series of model tests and computational fluid dynamic (CFD) assessments are required in such cases. When considering hull form optimization, it is beneficial to include sister ships in the CFD analysis to reduce the cost for the fleet. |

| Hull coatings | One way of lowering the frictional resistance is to improve the smoothness of a hull by means of coatings that reduce fouling. In recent years there has been a lot of development in the coating technology, e.g. introduction of hydrogel, a component that traps a microscopic layer of water on the coating’s surface, smoothing the water flow around the hull.The use of hydrogel containing coatings makes the surface of the hull behave like a liquid on a microscopic level. This not only deters fouling from occurring in the first place, but also significantly reduces hull friction. |

| Air lubrication | Air lubrication is a method to reduce the frictional resistance between the ship’s hull and water using a sheet of air or air bubbles. This saves energy and cuts down on fuel consumption. An automation system regulates the compressors/blowers depending on speed. In ideal situations, an air injection system can achieve up to a 15% reduction of CO2 emissions together with significant fuel savings.As compared to ships with v-shaped bottoms, this system is more effective on flat bottoms as the air on a v-shaped bottom will flow away more easily than on a flat bottom. |

| Propellers and rudders | Numerous devices have been designed for improving the ship’s energy efficiency by recovering as much as possible of the rotational energy in the flow from the propeller, or to provide some pre- or post-rotation of the in-flow into and after the propeller to ensure best performance. |

| Electric (battery powered) propulsion | In recent years, pure battery-electric propulsion, using lithium ion (Li-ion) batteries, has been successfully applied on small, short-sea vessels.The potential for batteries in combination with a two-stroke main engine in a hybrid system is being evaluated for larger ocean-going vessels. |

| Hydrogen fuel cells | Hydrogen fuel cells work in a similar manner to an electric battery, i.e., they convert chemical energy into electrical energy using the movement of charged hydrogen ions across an electrolyte membrane to generate current. There they recombine with oxygen to produce water – a fuel cell’s only emission, alongside hot air. They do not deplete or need charging and have a higher power density and lower weight than batteries.However, they are expensive and any leakage, if not handled properly, may cause hydrogen accumulation and explosion. Therefore, the hydrogen storage place and fuel cell cabin require appropriate measures to ensure safe integrity levels. |

| Shore to ship power (cold ironing) | This is the process of providing shoreside electrical power to a ship at berth while its main and auxiliary engines are turned off. When a ship is in port, auxiliary engines (generators) are commonly used to provide power for cargo operations, emergency equipment, cooling, heating, lighting as well as for domestic use. By simply turning off generators and plugging in to an electrical supply point in the ports, fuel consumption saving and subsequently reduction of noise and air emission may be achieved.Smaller vessels with low power requirements can make use of normal grid voltage and frequency. However, for larger vessels with high power requirements only limited ports may be able to provide cold ironing. |

| Waste heat recovery systems | A waste-heat recovery system (WHRS) recovers the thermal energy from the exhaust gas and converts it into electrical energy, while the residual heat can further be used for ship services (such as hot water and steam). The system may consist of an exhaust gas boiler (or combined with oil fired boiler), a power turbine and/or a steam turbine with alternator. Redesigning the ship layout can efficiently accommodate the boilers on the ship. There is potential for a reduction in main engine fuel consumption estimated at 3% to 8% which will contribute to overall emissions reductions.Waste heat recovery is well proven onboard ships, but the potential is variable depending on the size, numbers, usage and efficiency of the engines on board. Furthermore, these measures are usually not relevant for retrofitting, due to large costs and efforts related to redesign, steel work, extra weight, etc. |

| Carbon capture and storage | This technology is at the very early development stage for ships. It involves the isolation and capturing of carbon emissions from the ship’s exhaust and preventing them from entering the atmosphere. However, suitable cryogenic storage tanks are needed to collect liquid cargo until the ship reaches port. Thereafter, the carbon can either be stored permanently underground in geological formations or utilised in carbon-consuming industries. |

| Solar panels | Solar panels are devices that convert light from the sun into electricity. Solar panels on ships are not common at present, but some installations have been installed on certain types of ships including car carriers, bulkers, passenger ferries and smaller domestic vessels by using marine grade solar panels. This solution may not suit container vessels because of the space required.The technology is in its infancy and is expected to become less expensive over time, but the panels are unlikely to become much more efficient or less space consuming. |

| Wind assisted propulsion systems | Wind-assisted propulsion systems (e.g., sail, kite, fixed-wing, Flettner rotors) utilise an old concept with a modern edge. The IMO has recognized this technology and included the effects of wind propulsion in MEPC.1/Circ. 815. However, it is considered as an auxiliary propulsion system that augments the primary propulsion system. In fact, most wind-assisted propulsion systems require a secondary source of energy to be operated. For example, Flettner rotors need to be started up by motors to develop their aerodynamic thrust forces.Clearly, the availability of wind is the most relevant factor for these systems to work well. Operational costs (maintenance, spare parts, replacement of components, etc.) need to be considered in addition to the fuel saving potential. |

Should shipowners consider contractual clauses to address carbon emissions regulations and alternative fuels?

The EEXI/CII regulations, the use of alternative fuels, and other environmental regulations towards shipping’s decarbonisation are likely to impact the performance of both existing and future contracts and the traditional rights and obligations of the parties involved. Commercial and legal challenges are likely to emerge and create disputes which are varied and complex.

Shipowners should be discussing with their counterparts over the allocation of responsibility, risks, and associated costs in terms of compliance with the various environmental proposals and regulations currently discussed amongst the industry and those that will emerge. Collaboration would be advisable so that a strategy is agreed with regard to compliance, enforcement, sanctions, and associated commercial consequences. In the same direction, the parties to the shipping contractual chain should consider and address within their contracts the risks and exposure connected to third party claims as well as any impact on insurance coverage. Other problems which may arise could be in terms of alternative fuels’ availability in the ports around the world; a carefully considered clause could reduce potential disputes between the parties.

Traditional time charters are expected to be most impacted however this does not mean that voyage charters will not be significantly affected. COAs and bareboat charters may also be impacted.

BIMCO has already published a clause which addresses compliance with EEXI and allocates responsibility and costs for implementing modifications and is suitable for both existing and future time charter parties. This clause, the EEXI Transition Clause For Time Charter Parties 2021, may also be used to address other energy saving technical measures that may be implemented to achieve compliance. However, such use of other energy saving measures is subject to agreement between the parties.

BIMCO has further published the Emission Trading Scheme Allowances (ETSA) Clause for Time Charter Parties 2022. The clause is designed to assist the parties entering into a charter party to allocate obligations and responsibilities in terms of obtaining, transferring, and surrendering allowances for greenhouse gas emissions from ships operating under an emissions scheme, such as the EU ETS. BIMCO also published the CII Operations Clause for Time Charter Parties 2022, which can be incorporated into existing or new time charter parties, to address the issues arising out of IMO’s carbon intensity indicator (CII) legislation and assist the industry to tackle with the associated complexities.

As the number of LNG fuelled ships is growing BIMCO has also drafted three LNG clauses covering matters related to LNG fuel quality, fuel delivery/redelivery, gas-freeing and cooling down and an operational clause. The following clauses have now been published:

a) LNG Bunker Operational Clause for Time Charter Parties

b) LNG Fuel Delivery Clause For Time Charter Parties,

c) LNG Fuel Gas freeing and Cool down Clause, and;

Intertanko had also previously published the LNG Bunkering Clause for Time Charter Parties in January 2021.

The parties may also wish to consider the various “climate” clauses published by the Chancery Lane Project which is a not-for-profit organisation where lawyers can collaborate to draft industry appropriate clauses. Amongst those relevant to shipping are clauses dealing with (i) maximising energy efficiency, (ii) incentivising fuel efficiency, (iii) fuel reporting etc.

A clause dealing with the use of alternative fuels is likely to be the next on the agenda for most future contracts and not just for BIMCO.

The club is providing assistance in terms of reviewing and commenting on charter party clauses with regard to how the costs and risks of complying with new measures might best be allocated between the parties.

What are the industry bodies doing on this topic?

Various industry bodies including IG, BIMCO, classification societies continue to monitor developments and provide guidance to the shipping community.

How is the club supporting members with their transition?

It is not the role of the club to tell members which alternative fuel strategies they should be adopting. That is a complex commercial decision for them. Rather, the club is focused on supporting and guiding its members through the transition, particularly in respect of risk issues, claims advice, loss prevention, and underwriting queries.

As mentioned in the introduction, the club has formed its own Alternative Fuels Working Group (AFWG) and a dedicated advisory panel (SAFAP) comprised of key professionals within the industry. The AFWG helps us to stay abreast of developments and allows us to develop our own internal expertise. It is busy preparing webinars on the subject and tailor-made presentations/briefings for members that request them.

SAFAP comprises representatives from key maritime bodies, shipowner organisations, professional advisory firms and members. SAFAP advises and informs the AFWG with the goal of sharing knowledge and assisting the club’s membership through the energy transition.

The club is committed to helping our members make a safe, sustainable and successful transition to greener energy solutions, in line with The Paris Agreement and the IMO’s goals.

Are there any cover issues associated with the use of alternative fuels generally?

From a club cover perspective, clubs will need to consider matters pertaining to both (i) contractual obligations, such as deviation, and (ii) fines, such as those imposed for non-compliance with the MARPOL regulations. It is anticipated, though currently uncertain, that most cover-related issues will arise in respect of fines.

Other than in cases of purely accidental discharge, P&I cover for pollution fines and associated expenses has only ever been available on a discretionary basis. For a discharge to be accidental, there should be no intention to cause the discharge. Rather, the discharge itself must be accidental. Situations of accidental pollution are rare, and we anticipate this will continue with the advent of alternative fuels.

The club’s board may exercise discretion in favour of the member if it is satisfied that the member took all such steps as appear to the board to have been reasonable to avoid the event giving rise to the fine. This involves a detailed scrutiny of the circumstances surrounding the offence, as well as an assessment of the environmental policies and procedures the member had in place.

There is no exclusion for any particular alternative fuel and a spill of an alternative fuel should involve similar considerations to a spill of a traditional fuel. As such, cover is anticipated to continue to support members using alternative fuels and to respond in the usual way to liabilities and claims arising from such fuels.

Will there be changes to the rules?

As developments in the alternative fuels space continue, there may be scope for additional cover or rule changes.

Does Standard Club have any recommendations for members at this time?

Members should be considering the different regulations that may apply to a particular vessel or fleet and the effective date of such regulations to ensure compliance. While the effective dates of the regulations is in some cases only months away, the steps for compliance require thoughtful deliberation and may require lengthy lead time for implementation. Contract reviews are highly recommended, and amendments may be required to mitigate the risk and cost of compliance. Overall, members should ensure they adopt a culture of adherence to the applicable regulations, embrace regular oversight and auditing of their compliance procedures, and maintain effective senior management oversight. Among other things, members will need to consider their overall fuel management strategy and policies, potential investment in vessel modifications and / or emerging technologies, and training of onboard and shore personnel. Members may also want to collaborate with experts and trading partners insofar as risk and cost allocation associated with GHG emission reduction practices.

Source Standard Club P&I Insurers