This enlightening article, shared by VPS Group Commercial Director, Steve Bee, offers invaluable insights for ship owners, bunker suppliers, traders, petroleum companies, and all stakeholders in the maritime industry. As a must-read resource, it meticulously analyzes the transformative shifts in marine bunker fuels trends throughout 2023. Steve Bee’s expertise provides a comprehensive understanding of the challenges, trends, and crucial developments in the industry, making it an essential read for anyone seeking valuable information and strategic insights in the dynamic world of marine bunker fuels.

2023 saw the continuing evolution and the widening of available maritime fuel types and grades, as the global shipping industry gathered decarbonisation momentum to reduce its emissions and achieve current and future legislation targets. Existing CII and EEXI requirements, the incoming EU ETS legislation, plus the slightly longer-term IMO legislation, saw increasing demand for additional testing, lower-carbon fuels, data and digitalisation solutions across the shipping sectors.

As the leading maritime decarbonisation testing and advisory services provider, VPS continued to be at the forefront of marine fuels and lubricants analysis, utilising our experience, expertise and innovative approach, to support this drive for a more sustainable shipping fleet.

Throughout the year, VPS witnessed further fuel quality issues with VLSFOs in terms of cold-flow property issues, sulphur compliance and cat-fines. HSFO and VLSFO suffered numerous degrees of chemical contamination, whilst MGO suffered from cold-flow, flash point and FAME off-specifications.

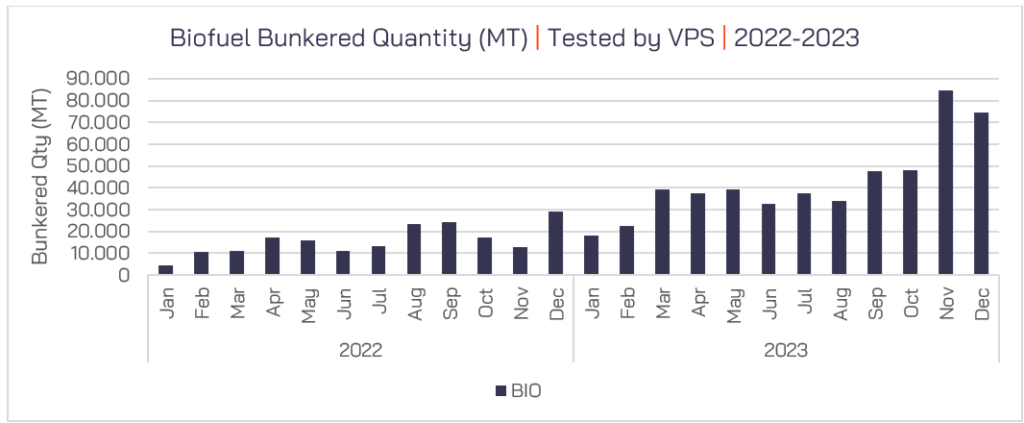

Biofuels usage certainly gathered momentum and the increased demand from the market led to increasing queries regarding their fuel management and their “fit-for-purpose” as a drop-in marine fuel, which in turn called upon VPS to provide answers and solutions to customers, utilising our extensive knowledge and understanding of biofuels and their associated test parameters.

The Marine Fuel Mix

Across 2023, the fuel mix with respect to samples received for testing in VPS laboratories, equated to 62.7 million MT, which is over 5 million MT of marine fuels per month. VLSFO was the most popular marine fuel with 54.3% of the fuels used, followed by 29.5% HSFO (a growth of 15.4% over 2022), 14.2% MGO, 1.2% ULSFO and 0.8% Biofuels. Regarding biofuels usage, the samples tested by VPS equated to an increase from 231,000 MT in 2022 to 558,000 MT in 2023.

VPS Bunker Alerts

Bunker Alerts highlight short term quality fuel quality issues identified by VPS, for a specific test parameter of a specific fuel grade/type in a specific port. The service provides valuable information to customers, to assist in avoiding potentially problematic fuel types in a highlighted port or region, to further protect the customer’s asset and crew.

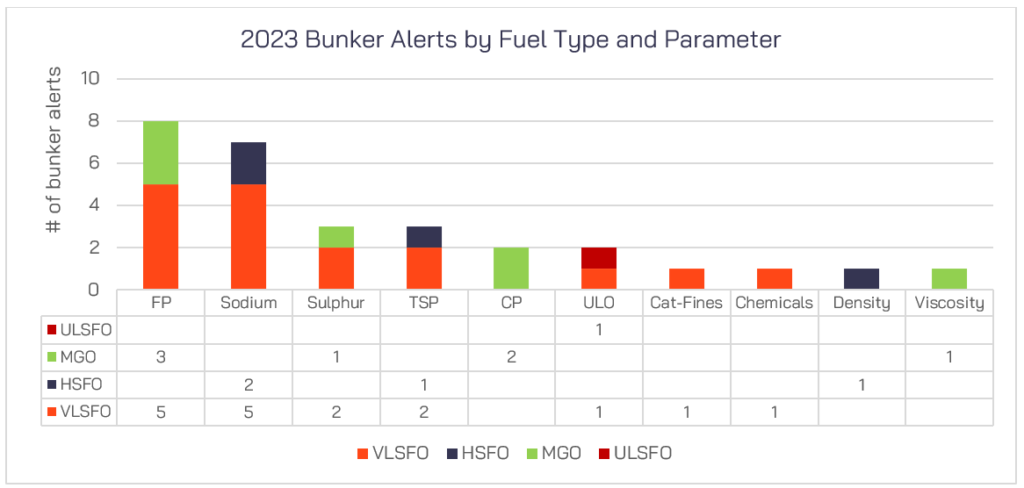

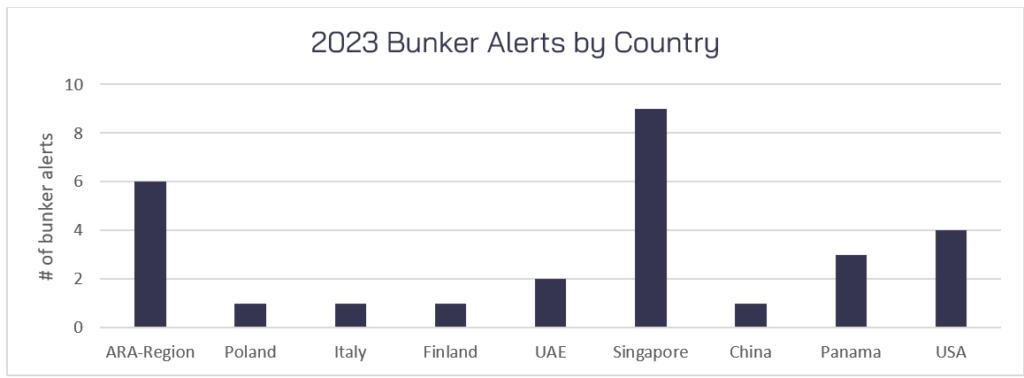

In 2023 VPS issued 28 Bunker Alerts, eight fewer than in 2022. The 2023 Bunker Alerts included all major fuel grades, i.e. VLSFO, HSFO, MGO and ULSFO, ten different test parameters, 12 ports and 9 countries.

58% of the 2023 Bunker Alerts were for VLSFO fuels, followed by 24% for MGO fuels and 14% for HSFO. The most common problematic parameter was Flash Point, accounting for 28% of the Bunker Alerts, followed by Sodium at 24%, with Sulphur and TSP at 10% each.

Singapore (32%) and ARA (21%) were the regions/ports most frequently requiring a Bunker Alert to be issued. But as these are the two busiest bunkering regions, it is not too surprising.

VLSFO Fuel Quality

As the most used marine fuel type, VLSFO accounts for more than half of the fuels tested by VPS. In terms of quality, Europe provided the highest level of off-specification VLSFOs in both 2023 (7.8%) and 2022 (7.9%). Africa provided the next highest level of off-specification fuels with 6.7% in 2023 and 7.0% in 2022, with North America third with 4.4% of fuels tested exhibiting at least one off-specification parameter in 2023 and 4.3% in 2022.

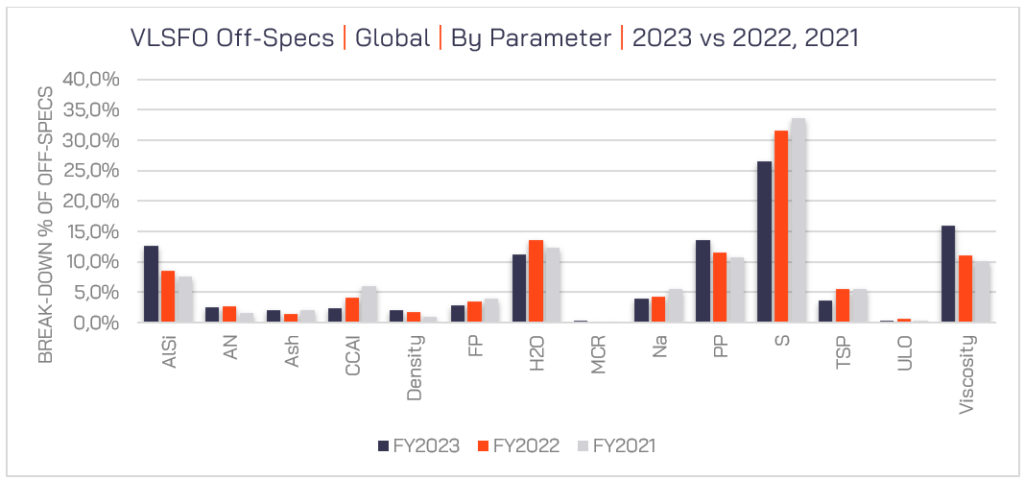

Sulphur is the most common off-specification parameter of VLSFOs, accounting for 26.6% of VLSFO off-specs in 2023 and 31.5% in 2022. 0.7% of VLSFOs tested in 2023 had a sulphur level of 0.50%-0.53%, with 0.5% of samples tested having a sulphur level greater than 0.53%.

Pour Point was also a common off-specification parameter for VLSFOs with 13.6% of VLSFOs off-specs relating to this parameter in 2023 an increase over the 11.4% level witnessed in 2022.

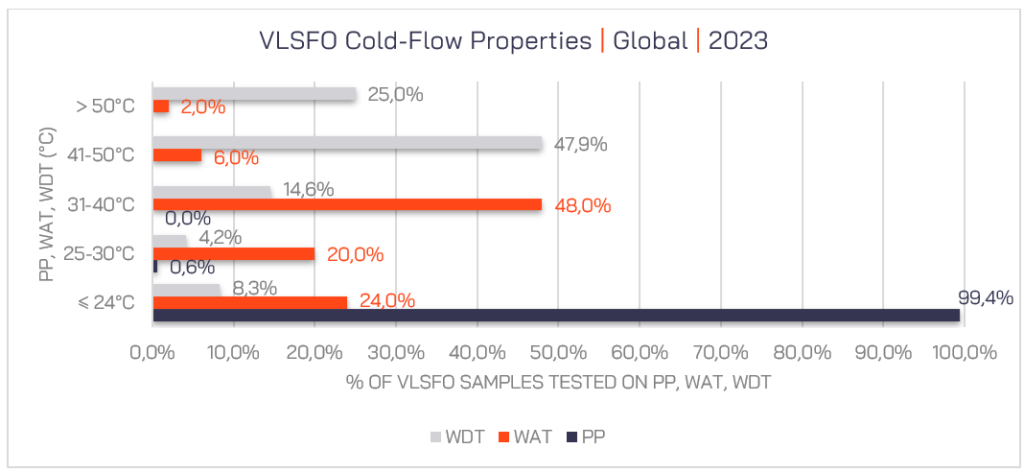

The importance of the additional cold-flow test of Wax Appearance Temperature (WAT) and Wax Disappearance Temperature (WDT), was highlighted in 2023 with 63% of VLSFOs exhibiting WAT of 31-40ºC and 14% having WAT between 41-50ºC. 55.7% of VLSFO samples had a WDT of 41-50ºC, with 28.1% having a WDT of >50ºC. VLSFOs cold-flow properties are a definite concern with wax precipitating from the fuel at temperatures way in excess of 10ºC above the pour point, potentially causing numerous operational problems such as filter and pipework blockages.

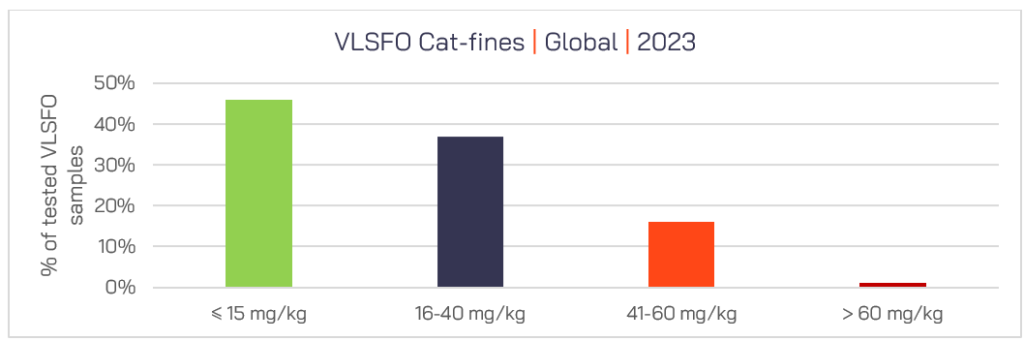

2023 also saw a significant increase in cat-fine levels in VLSFOs, with 12.7% of all off-specifications relating to this parameter, compared to 8.5% in 2022. 16.2% of all VLSFOs showed a cat-fine level greater than 40ppm. Frequent checking of purifier efficiency via VPS’ Fuel System Checks (FSC) service is a highly recommended proactive safeguard in respect to increased cat-fines within VLSFOs.

VLSFO viscosities vary enormously depending upon to blend components used. In 2023 VLSFO viscosities ranged from <20Cst to >380Cst. 16% of all VLSFO off-specifications were due to viscosity. Only 0.5% of VLSFOs had a viscosity of >380Cst. 68% of all VLSFO viscosities were less than 180Cst. Viscosity is such a key operational parameter, determining the transfer and injection temperatures of fuel onboard ships and therefore determining the exact viscosity of VLSFOs is crucial to ensure optimal efficiency.

HSFO Fuel Quality

HSFO represents almost 30% of all bunker samples received by VPS for testing, indicating a relatively high level of scrubber usage onboard vessels today. In terms of HSFO off-specifications, South America accounted for 30.9% of off-specs, compared to 25.1% in 2022. Second highest off-spec region was Europe, with 21.4% in 2023 compared to 24.3% in 2022 and North America was third with 9.5% of HSFO off-specs in 2023, compared to 11% in 2022.

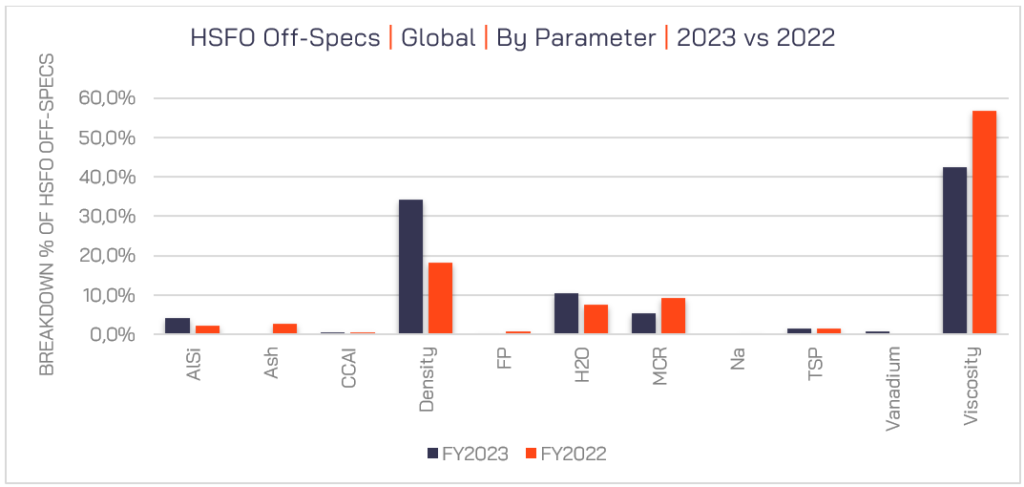

As usual, viscosity and density were the two most common HSFO off-spec parameters in 2023, with 42.5% of the off-spec attributed to viscosity and 34.3% to density, compared to 56.7% and 18.2% respectively in 2022. Water was the third most frequent HSFO off-specification parameter in 2023, with 10.5% off-spec level compared to 7.6% in 2022.

Whilst cat-fines accounted for 4.2% of HSFO off-specs in 2023, this was almost double the 2022 level of 2.2%. Again, like VLSFOs it highlights the importance of Fuel System Checks (FSC) to protect the engine from potential damage from this corrosive contaminant, by improving purifier efficiency. 20.3% of HSFOs had a cat-fine level of >40ppm in 2023.

With both VLSFO and HSFO we did see cases of vessel damages due to chemical contamination during 2023. Focusing specifically on the VPS GCMS-Head Space Chemical Screening service, as a damage prevention service, 19.9% of applicable marine fuel samples received by VPS since 2018, have undertaken this rapid, pre-burn protection service, with an average 8% of samples tested, giving rise to a “Caution” result, indicating the presence of at least one chemical contaminant.

MGO Fuel Quality

MGO accounts for 14% of all samples received by VPS for testing. Many ship owners and operators choose not to test MGO, believing this fuel type is problem-free. However, this could not be further from the truth. In 2023, Singapore accounted for 15.9% of all MGO off-specifications, which was a huge increase on the 6.6% Singapore experienced in 2022. Asia-Pacific was the next highest region in terms of MGO off-specs with 8.4%, followed by Europe showing 8% of all MGO off-specifications.

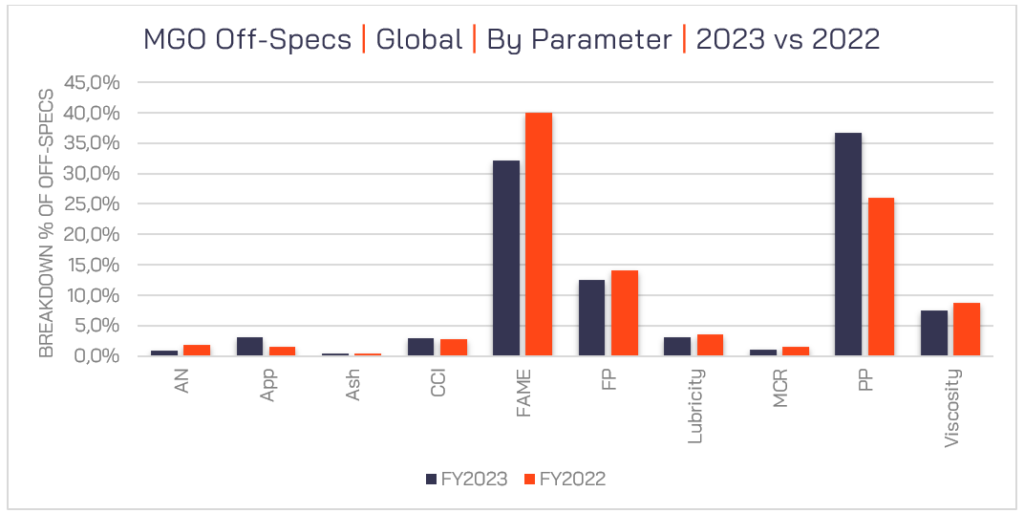

Pour Point was the most common MGO off-specification parameter in 2023, with 36.6% of MGO off-specs attributed to Pour Point. During the last quarter of 2023 we witnessed a significant increase in Pour Point (& CFPP), cold-flow property related issues in the ARA region & Gibraltar for distillate fuels and the potential wax-precipitation from these fuel which could occur.

FAME contamination was the second most common MGO off-specification parameter accounting for 32.1% of all MGO off-specs. As FAME is a common component within automotive, aviation fuels and now some marine fuels, it is not surprising we are seeing such levels of off-specification.

Flash Point was the third most common MGO off-specification parameter, with 12.6% of MGO off-specs attributed to Flash Point. Flash Point, accounted for 28% of the Bunker Alerts in 2023, with three out of eight Flash Point Bunker Alerts being for MGO fuels.

Biofuels

As global shipping looks towards low-to-zero carbon fuels to answer many emissions reduction challenges, biofuels offer an immediate “drop-in” solution. As such VPS tested the equivalent of over 500,000 MT of biofuels in 2023 compared to ca. 230,000 MT in 2022.

Europe, (mainly ARA-region) provided the highest volume of biofuels at almost 400K MT (ca. 74%) and Singapore second (ca. 21%), providing just over 100K MT.

The most common biofuel blend was B30 (10-30% bio), which accounted for 34.3% of biofuel samples tested by VPS. Yet, B100 (>90% bio) was not far behind with 30.1%.

The majority of biofuels contained Fatty Acid Methyl Esters (FAME) as the bio-component, although VPS did test others containing HVO, HEFA, Cashew Nut Shell Liquid (CNSL) and Tyre Pyrolysis Oil (TPO).

Where FAME is the bio-component within marine biofuels, the key considerations are:

- Energy Content, Renewable Content

- Fuel Stability, Cold-Flow Properties

- Corrosivity, Microbial Growth

Of the biofuels tested by VPS in 2023, 9% of those tested for oxidation stability gave the concerning result of <5 hours, highlighting a high degree of instability, whilst 6.7% gave a result of 5-8 hours which is still a cause for concern.

In terms of corrosivity, 11.9% of those biofuels tested provided an amber/caution result, whilst 8.5% of those tested provide a red warning, indicating potential high levels of corrosivity.

It is fully expected that the growth in biofuels usage for marine applications will continue to increase across 2024 and the VPS Additional Protection Service (APS) when using biofuels, will only increase in importance as the industry looks for more information regarding the fuel management of biofuels.

Summary

2023 once again highlighted the importance of bunker fuel quality testing, as a proactive means to protect vessels, their crew and the environment. With additional tests, currently not included within ISO8217, providing further vital information in achieving heightened levels of protection.

Whilst we can expect a new revision of ISO8217 in early 2024, additional tests will still hold an important role in fuel management.

Biofuels usage will continue to increase in demand and importance, as ship owners and operators look to achieve improvements through CII and EEXI, as well as looking to counter the financial impact of the EU ETS scheme.

Methanol demand and usage will also grow, following the recent success of Maersk’s Laura Maersk and the rapidly growing order book for methanol-powered vessels.

So 2024, suggests another year of widening marine fuel types and grades coming to market, coupled with their growing fuel management considerations.

For further support to your fuel management issues, contact marketing team of VPS Here

Source VPS Veritas Petroleum Services