2022 saw a record boom in crude and product tanker freight rates. Geopolitical tensions between Russia and Ukraine reshaped the macroeconomic scene and we entered a new era of changed seaborne oil trade flows. December 5, 2022, was the day the new era began with the enforcement of the EU ban on Russian oil trade.

In parallel, the G7 price cap for crude oil and petroleum originating in or exported from Russia of $60 per barrel went into effect. The current decision provides for a transitional period of 45 days for vessels carrying crude oil originating in Russia that was purchased and loaded onto the vessel before December 5, 2022, and discharged at the final port of destination before January 19, 2023. In addition, there is a transition period of 90 days after any change in the price cap to ensure consistent implementation by all operators.

The year ends with critical macroeconomic challenges for the future of VLCCs and crude oil freight rates. There is uncertainty about how oil supply will evolve given current oil demand growth and the impact on trade flows as Europe continued to rely on Russian crude oil imports through the end of the third quarter.

There are many discussions about the existing trade and scenarios about a possible dark trade involving Russia-linked tankers. At the same time, most European shipowners already prefer to avoid any cargo related to Russian oil, while Asia continues to buy large quantities of Russian oil. Before the new year begins, we take a moment to consider the impact of recent decisions by analyzing the crude oil tanker industry today.

Using Signal Ocean data, we examine the dynamics of the freight market and the current patterns of oil flows that will play a critical role in the development of shipping revenues over the next year. A year ago, pandemic concerns were at the top of the agenda due to the negative impact on freight rates, demand and supply of vessels, while now we are facing critical geopolitical challenges in the oil sector that are leading to an increasing change in demand for tonne-miles and days for crude oil transportation.

Brief overview of today’s picture

It looks like the fourth quarter of the year will end with a downward trend in VLCC rates, while Suezmax and Aframax Baltic Sea – Med rates are exceptionally strong. We expect Russian oil exports from Black Sea and Baltic ports to Asia to replace oil exports from the United States, which will further dampen future VLCC demand.

However, VLCC demand in terms of tonne-days and miles is still significantly higher than in the previous two years, fueling positive expectations for VLCC freight revenues in the days ahead. Interestingly, the upswing in freight rates observed last quarter continues to be reflected in the upward trend in vessel speeds. Current speed figures have surpassed the levels of the previous two years and are now at their highest level since the beginning of the year.

In the following sections, we show this year’s trends compared to last year for the key elements: oil flows, demand, vessel speeds and supply.

I. Oil Flows – Redirection of Russian oil to Asia

The reduction in European countries’ dependence on Russian oil is shown in image 1, with seaborne imports for the main destinations falling significantly in September, October, and November. However, in the last days before the ban came into effect on December 5, there was a slight increase in monthly volumes of Russian crude oil for Europe, which was almost expected as we approach a new era of oil flows by sea.

Looking at Asia (image 2), it is clear that China and India, as well as the main Asian countries, have steadily taken off larger volumes of Russian crude oil from April to November, resulting in a historic record for Russian oil shipments destined for Asia in the current year. It remains to be seen whether the price cap introduced by the G7 countries will affect the consistency of Russian crude oil supplies to Asia. A few days ago, Reuters reported that Russia’s flagship crude oil from the Urals was being sold at even greater discounts following the European ban on Russian oil imports, and that the main buyer, India, was buying barrels at a price well below the $60 price ceiling agreed to by the West. Overall, Russia is looking to Asian buyers for about 1 million barrels per day as the European Union cuts back on imports from Moscow.

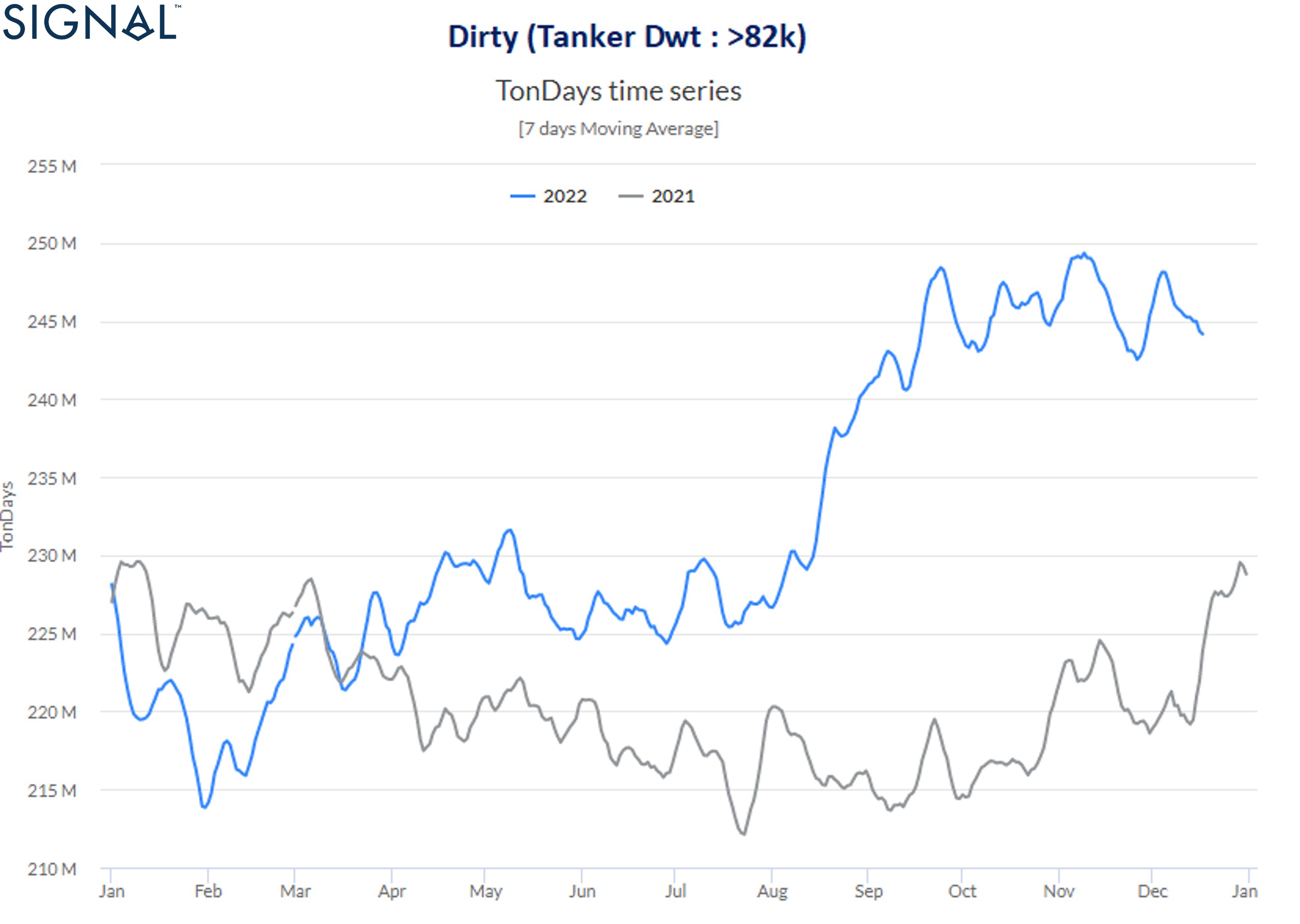

II. Demand Growth – Tonne Charts

The changing geopolitical situation, with Russia looking to Asian trading partners, has seen demand tonne days rise to historic record levels this year, (image 3), with a significant boom beginning in August. Since the end of the third quarter of this year, there has been a steady increase to over 240 million metric tonne days, and it is very likely that these spectacular levels will continue as Russia looks for alternative buyers for its oil. The fourth quarter of this year has seen slower growth, but levels are still much higher than November and December last year (around 220-225 million tonnes).

The upward trend in aggregate demand is largely due to the increase in VLCC tonne days, (image 4), which have risen to over 140 million since August and remained high through November. Although there were signs of a significant downward trend in November below the 140 million ceiling recorded in the third quarter, the trend finally reversed in early December. Concerns have been raised in recent days that the exceptional growth may be eroding, but there is no denying that the current trend in VLCC demand growth remains exceptionally higher than last year.

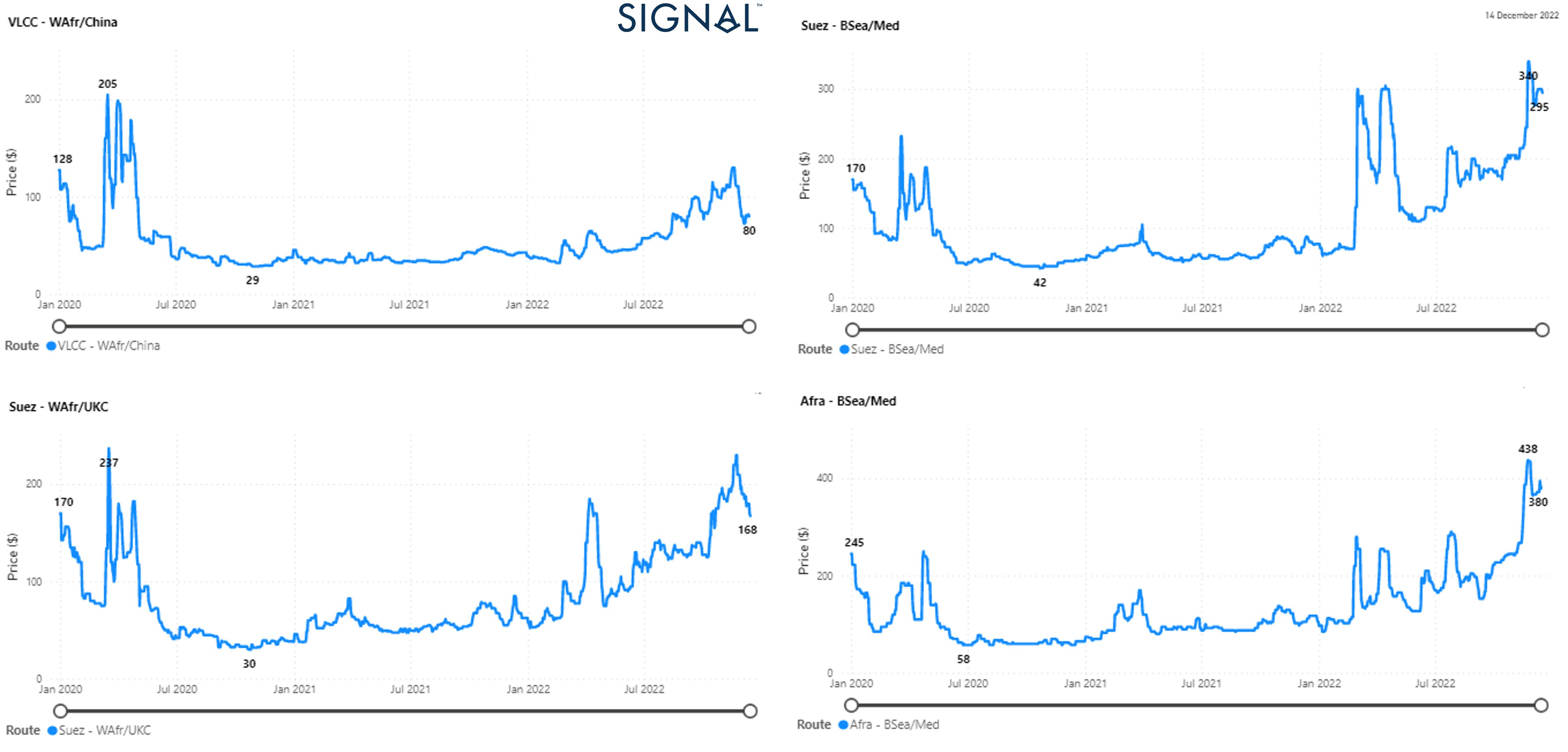

III. Freight Market – WS

A look back at 2020 (image 5) to the current year clearly shows that in that year, the market’s upturn exceeded all expectations of a possible upturn. After the first quarter of 2020, the third quarter of this year took crude oil market rates in the Baltic/Med route for the Suezmax and Aframax segments to new record highs not seen since early 2020. In the Suezmax segment, BSea/Med Worldscale (WS) rates rose to over 300 and in the Aframax segment to over WS400.

Overall, we see that Suezmax and Aframax vessels are largely influenced by the new patterns of dirty sea flows amid ongoing geopolitical tensions, while VLCC market sentiment is influenced by the Chinese economic situation and deteriorating demand due to zero policy COVID.

Interestingly, the third quarter of this year brought an upswing for the VLCC segment. VLCC AG-FE rates rose to WS100 between late October and early November before falling to near WS80 in mid-December. The current trend is still well above the January 2022 lows, which were less than 40 WS, and it does not look like the current strength is eroding as vessel supply is trending downward.

IV. Vessel Speeds

The upward cycle in the freight market this year has seen crude oil tanker ballast speeds rise steadily since the end of the summer season. The average ballast speed of crude oil tankers at sea is now 11.9 knots, up from 11.3 knots during the same period last year. (image 6) The latest figures are the highest since the beginning of 2020, with the VLCC segment playing an important role in the current increase in seagoing vessel ballast speed.

Looking at the VLCC segment, (image 7), the ballast speed at sea increased to over 12.5 knots in November, while it was 12.4 knots in mid-December, compared to 11.7 knots in December last year. It is the first time since early 2020 that ballast speed of VLCC tankers exceeds 12 knots, and the upward trend will continue as long as freight rates remain stable on WS.

V. Vessel Supply

The supply of vessels for VLCC tankers is now at its lowest level since the beginning of this year. The number of vessels has been consistently below the average of 80 since mid-August and even below 60 in the fourth quarter, and it looks like December will end with a new record low for the year (image 8). The current supply figures, together with stable growth in demand (tonne-days), will continue to drive the upward trend in freight rates in the coming months of the new year.

Overall outlook – Looking ahead

IMO regulations and the net-zero emissions target for the next decade require major investments in improved green technologies to convert ships to cleaner fuels. Fleet growth is slowing as more ships are scrapped and fewer new ships are ordered. Currently, more investment is flowing into the second hand ship market as European shipowners will no longer be able to meet the needs of the Russian oil trade destined for Asian buyers. In the last two quarters, we have seen an increase in purchases of used crude oil tankers from European to Asian shipowners, which has supported an upward trend in ship prices.

It does not look like the tanker market will navigate through a weaker demand environment as the enforcement of the EU ban transforms existing trading patterns into new ones. However, there is growing concern about weaker crude oil demand from China. The risk of a global recession has increased and economic activity in China continues to disappoint, while the recent easing of the zero policy COVID in early December brings some relief for the final quarter. While uncertainties remain, all signs point to a solid increase in crude oil freight rates in 2023 and higher vessel speeds due to slower net fleet growth and higher growth in demand (tonne-days).

Source The Signal Group By Maria Bertzeletou