Trafigura publishes 2022 Annual Results showing a strong performance in a highly challenging environment,

Trafigura Group Pte Ltd, a market leader in the global commodities industry, today released its results for its financial year ending 30 September 2022. It was a year where the Group helped its customers to navigate turbulent markets and disrupted global supply chains and where strong demand for its services and its ability to manage risk delivered record results.

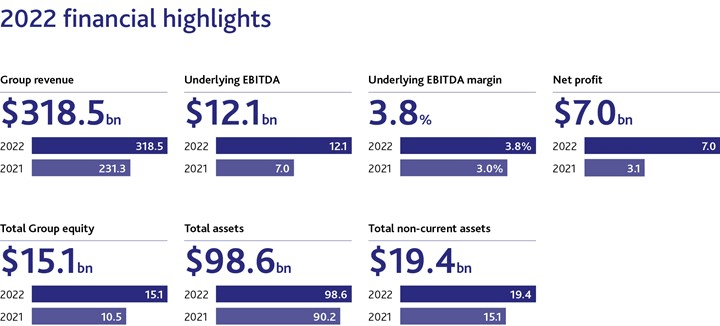

Profit for the year of USD7,026 million was more than double the previous year’s level of USD3,075 million. Revenues increased by 38 percent to USD318,476 million from USD231,308 million in 2021. The Group’s underlying earnings before interest, tax, depreciation and amortisation (EBITDA) margin for the year was 3.8 percent, compared to 3.0 percent in 2021.

The total volume of commodities traded in 2022 was lower year-on-year. This was due to a reduction in oil and petroleum products volumes in the second half of the financial year, driven by the termination of long-term contracts for Russian crude oil and products in light of international sanctions, reduced availability of hedging in derivatives markets used to manage price risk, and a decision to focus on higher-margin opportunities.

Trafigura traded an average of 6.6 million barrels of oil and petroleum products per day in the financial year 2022, compared to the daily average of 7.0 million barrels in 2021. Non‑ferrous metals traded volumes were flat at 23.3 million metric tonnes, while bulk minerals volumes, driven by increased iron ore volumes, rose by 10 percent to 91.3 million metric tonnes.

The strong performance allowed for a further strengthening of the balance sheet, with Group equity almost doubling over the past two years to USD15.1 billion. An additional USD7 billion of financing was secured in financial year 2022, bringing total credit lines to USD73 billion, provided by a network of around 140 banks globally1.

Jeremy Weir, Trafigura’s Executive Chairman and Chief Executive Officer said: “The past year saw our people work hard to solve the disruptions created by unprecedented market volatility and the big structural shifts that are shaping our industry. It has shown that what we do – connecting vital resources to help power and build the world – has not only become more complex but also more critical and in demand than ever before.”

Additional key points:

- The Group responded to new rules and regulations that came into force across multiple jurisdictions following Russia’s invasion of Ukraine. Long-term contracts with Russian state-owned entities were terminated ahead of sanctions taking effect in May and its sole investment in Russia – a 10 percent minority stake in Vostok Oil – was exited in a transaction that completed in July.

- In its first full year following consolidation, Puma Energy’s management team divested a significant part of its infrastructure and storage assets, as part of a wider plan to refocus the business on downstream operations and to reduce debt.

- The Group was part of a consortium awarded the concession to refurbish and operate a near 1,300 km railway running from the Lobito port on the Atlantic coast of Angola to the border with the Democratic Republic of Congo. The Lobito Atlantic railway will offer a western route to market for crucial energy transition metals that is safer and less congested or prone to delay than existing eastern and southern routes. The project is expected to require a total investment of USD450 million over a 30-year concession, including USD170 million investment in new rolling stock.

- Nyrstar recorded a loss due to operational issues in Australia and soaring power prices which forced the company to curtail production at its European smelters.

- Nala Renewables, a 50:50 joint venture between Trafigura and fund management group IFM Investors, continued to develop a number of solar power, onshore wind and battery storage investments to progress towards its 4GW renewable energy target by 2025. Trafigura has also made a string of early stage investments in companies involved in new energy technologies and continues to see hydrogen‑derived fuels as one of the key commodities of the future.

- Our joint venture H2 Energy Europe is working towards a final investment decision on a project to build a one gigawatt renewable hydrogen production plant in Denmark, to provide zero‑carbon fuel for trucks and other heavy transport vehicles.

- In its first full year of operation, the Group’s Carbon Trading team continued to build its capabilities and investments across regulatory and voluntary carbon markets, including becoming an anchor buyer of nature-based carbon removals from the Delta Blue Carbon mangroves restoration project in Pakistan.

- Good progress has been made to reduce greenhouse gas emissions from operations by 30 percent compared to a 2020 baseline. Longer-term targets will be announced in the Group’s 2022 Sustainability Report, to be published in January.

“Whilst the new financial year has started well, we need to remain focused and vigilant in a period that is likely to be at least as challenging as 2022. Trafigura is well positioned to continue to manage the challenges and supply the vital resources our customers need in the year ahead,” concluded Jeremy Weir.

Media & Press Release Trafigura